Opinion: Now is not the Time for Church Tax Exemptions

- Gabriela Vasquez

- May 9, 2023

- 3 min read

By Gabriela Vasquez

In a country that is founded as "one nation, under God," the separation of Church and State is simply a formality. Is there much of a separation in modern politics? What is the line between partisan politics, and politics influenced by religious beliefs?

One example of religious preference in the modern era is the tax exemption status of religious institutions when it comes to paying property taxes. According to IRS tax code 501(c)(3), charitable organizations, including religious entities, are exempt from paying property taxes so long as they do not benefit private interests or influence legislation or political campaigns. Texas tax laws maintain similar requirements, and additionally protect the tax exemption status of parsonages, or properties that house leaders of Church congregations.

However, in years past, Church leaders have caused uproars of controversy for speaking in favor of political campaigns, thus violating the terms that grant the tax exemption for their campuses. For example, before the midterm elections in November 2022, Ed Young, pastor at Second Baptist Church, said during one of his sermons,"If Houston and Harris County is to survive, we had better throw those bums out of office,"in reference to the Democrats holding office at the time. However, he faced zero repercussions from the IRS, and Second Baptist maintained its tax-exempt status.

These exemption tax laws have been instated in Texas since 1928, as legislators voted and wrote into law the tax exemption status for properties occupied by clergy members.

In an interview expressing his opinion on religious tax exemptions, Dr. Johnny Buckles, tax law professor and attorney at the University of Houston Law Center, stated, "One argument against...any charitable tax exemption including religious entities…is that the government needs money and by exempting [property taxes], public funds are lesser. That is particularly true when churches are located in areas with very high land values."

"On the other side of that...the government recognizes that numerous charitable organizations provide stabilizing effects on the community [and] public externalities with their operations and so, by exempting the churches, mosques, and synagogues, the government is just doing the same kind of things for them that it's doing to a number of organizations like schools and hospitals that are serivng a broad section of the community," Dr. Buckles said.

"Similarly, many argue that the entities that receive the tax exemption are already providing public benefits in a way that private entities are not…if you were to tax them, you would be impairing to some degree their ability to provide as much benefit to the public that they are already providing."

Bad Timing

While this tax exemption exists for religious organizations and charities to promote their nonprofit work in local communities, this status just seems to be a bit of a nuisance in today's post-Covid economy.

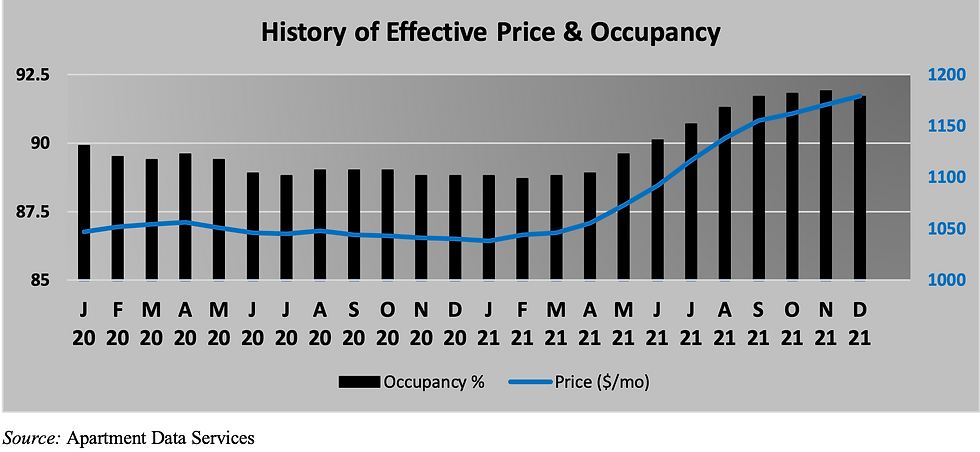

Home prices have rapidly increased since 2020, according to the Harris County Appraisal District's 2022 Annual Report, and the same can be said for rent prices.

From the end of 2020 to the end of 2021, the rental rate of Houston apartments increased by 14.6%,and the price of apartments have understandably increased alongside this increase in demand.

Whether people are paying property taxes or simply renting, prices have increased, leading to a rapid increase in eviction filings after the Emergency Rental Assistance Program's effects began to ware off after the pandemic.

Super Neighborhoods with Super Salaries

The city of Houston is divided by Super Neighborhoods, and some of the largest church campuses are located in the richest areas. For example, Lakewood Church is located in the Greenway/Upper Kirby Super Neighborhood, and Second Baptist's Woodway campus is located in the Greater Uptown Super Neighborhood.

Because these large campuses are located in the highest income communities, their exemption values are high according to the Harris County Appraisal District.

Second Baptist, Woodway Campus

Lakewood Church

Campus | Property Area (Square Feet) | Exemption Value ($) | Year |

Lakewood | 302,507 | 43,250,700 | 2022 |

Second Baptist (Woodway) | 1,363,894 | 47,312,577 | 2022 |

Second Baptist (West) | 1,071,900 | 41,010,000 | 2022 |

First Baptist | 361,330 | 26,764,248 | 2022 |

Source: HCAD

The property taxes on these church campuses would greatly impact the public funding of Houston in theory. However, Jack Barnett, Chief Communications Officer at the Harris County Appraisal District states that this tax exemption does not affect the county's yearly market and budget.

"There are requirements that have to be met before [religious entities] can get an exemption, but if they are granted the exemption, then that property [almost becomes] like it doesn't exist there," Barnett said. "I really don't know if it has an impact on the surrounding property owners."

Comments